GST Gives Big Relief to Small Traders/ Manufacturers/ Restaurants

Manufacturer/Service provider/Trader whose annual turnover is below Rs.20 Lakh* need not pay any GST and need not register.

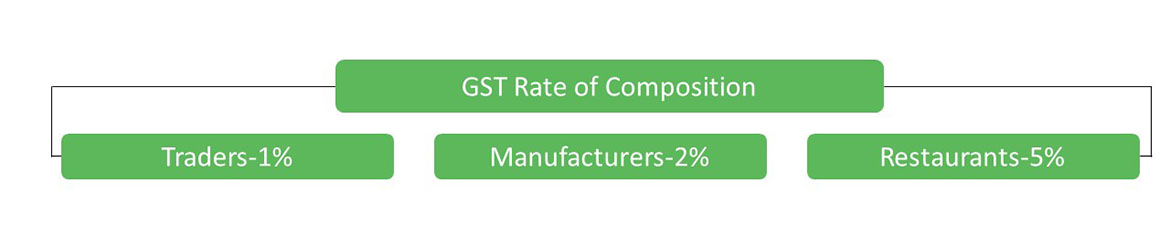

Those with annual turnover upto Rs.75 Lakh# can opt for composition scheme in which case the tax rates will be as follows:-

In service sector, Composition Scheme is available only for one sector-restaurants.

The Composition scheme is not available for manufacturers of tobacco and manufactured tobacco substitutes, pan-masala & ice-cream and other edible ice, whether or not containing cocoa.

The dealers who opt for composition scheme have to file only one quarterly return with details of total turnover. Invoice with details are not necessary, bill of supply will suffice.

Small taxpayers are not required to give HSN code in their returns.

However,in this option, no input tax credit can be taken or passed on.

With online registration, return, payment,refund & other processes,delays and discretions would be reduced.

Reduced compliance burden.

Special dispensation for job-work to help job workers in the GST regime.

* This limit is Rs 10 Lakh for Assam, Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Tripura,

Sikkim, Uttarakhand and Himachal Pradesh.

# This limit is Rs 50 Lakh for Assam, Arunachal Pradesh, Manipur,Meghalaya, Mizoram,Nagaland,Tripura,

Sikkim, Uttarakhand and Himachal Pradesh.