GST Impact Analysis

What is GST Impact Analysis ?

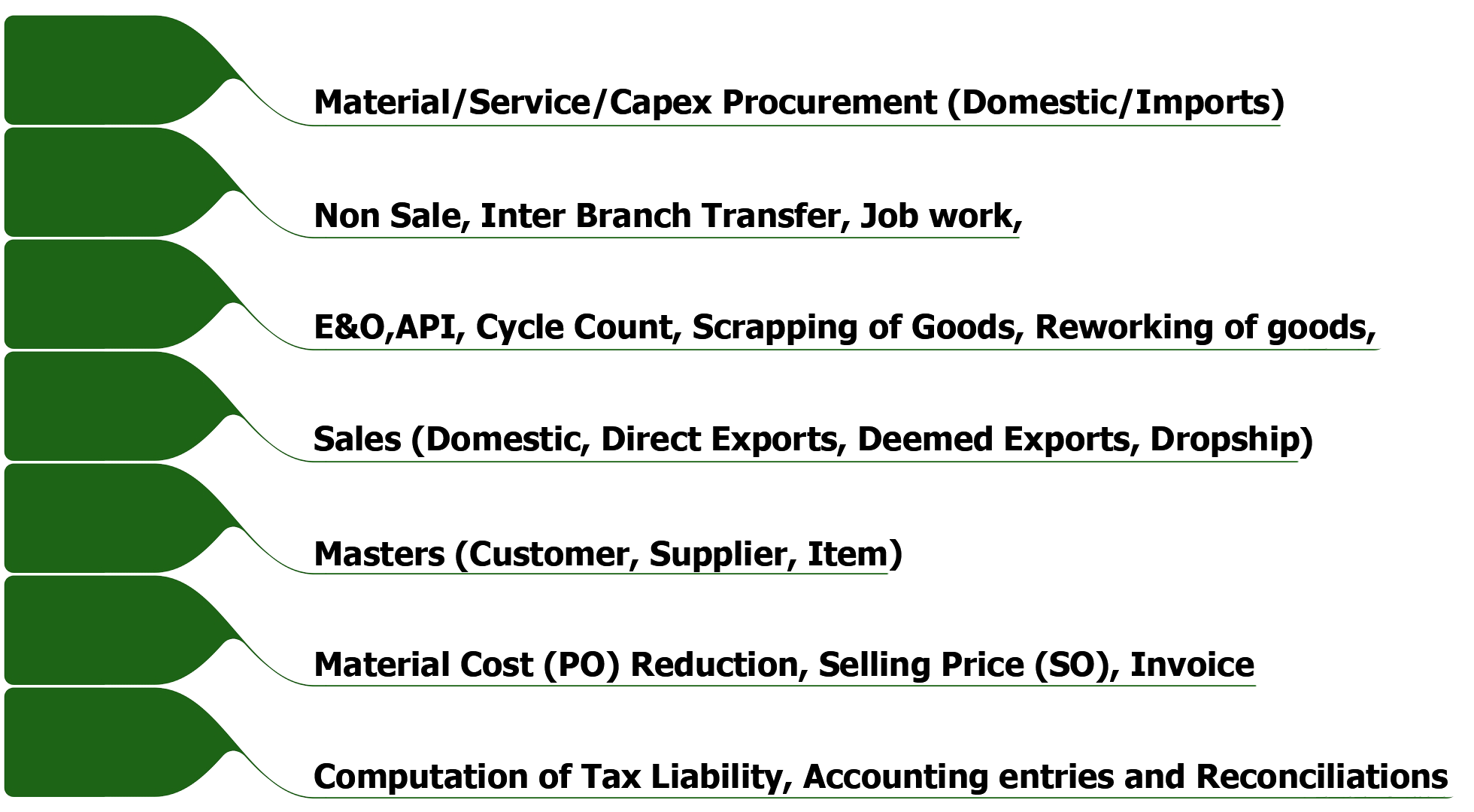

The plan is designed to enable businesses understand how GST is going to impact their operating cost, profitability, working capital requirement, IT reporting system, and other elements. Get expert advice and learn how your entity can plan out the required shift in IT infrastructure to record and generate reports as per GST, plan inventory level, frame logistics strategy, carry forward input tax credit , and take informed financial decisions.

Documents Required for GST Impact Analysis

1. Balance sheet and P&L account

2. Details of custom duty payment

3. Service Tax returns (along with Cenvat credit details)

4. VAT audit reports

5. Central Excise returns (including annual returns)